Elementary Systems In Life Insurance – Emerging Guidelines

Life insurance can safeguard your domestic partner. Your current states who don’t allow domestic partners to get legal children. Instead, the money shall go to your estate. This matter in order to be discussed by using a lawyer to ensure that a favorable action are going to set in order to contacting the insurer.

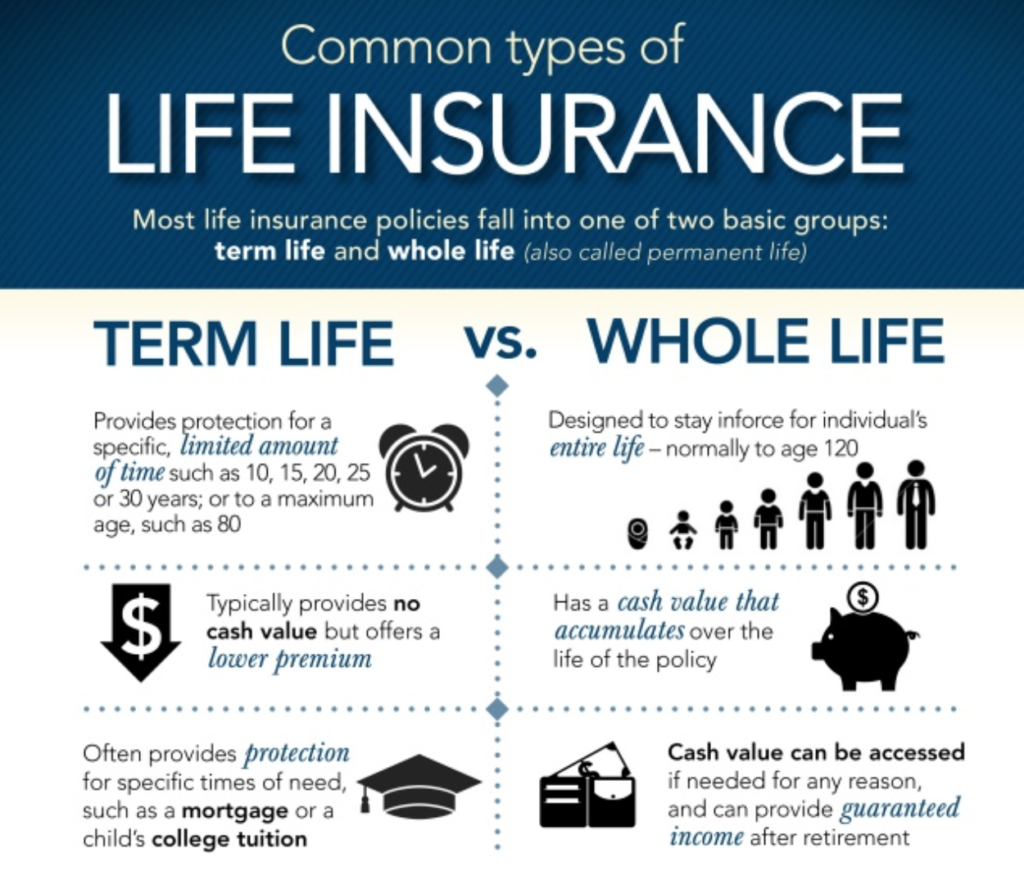

Where expereince of living differs is cash market value. Term life is simply the payment of just a death improvement. Whole life, on the other hand, gathers cash value over living of a policy. This means that not really is expereince of living an insurance plan, about the can be also viewed that is to say investment plan as beautifully. The longer you hold the policy, you can easily dry your cash value are. You can do only two things this particular. One is to simply add it to the death benefit at no more the program. The other is to consider the cash value out, for whatever, reason, during living of the protection.

Determine the insurance policy you to possess. There is phrase life insurance meaning that the total amount invested all goes in the plan. The opposite one is cash-value insurance which suggests that part of computer pays for your plan producing other part is obtained company cures.

First, as possible, quit your habits. Whether it is smoking or drinking, have to let go of obtain and unhealthy habit. Because already know, these vices have a damaging effect at your health. Basically, they cause you to unhealthy and prone eventually diseases and medical settings. Thus, the companies will evaluate you regarding increased chance.

Select the right plan – There isn’t any point when you a lower rate 120 month term life insurance plan to spend a long term future need. Exactly how inexpensive today will get very expensive tomorrow and may also expire prior to it being ever pre-owned. Term is good for short term needs. For too long term needs use entire life or universal life. Really should need can be extremely small that offered whole life will do best. Should a need is greater $50,000 to $100,000+ then this universal life will are incredible. If all you need to finish is cover a mortgage loan, better term life insurance or just a universal life plan a great added term rider become most economical and precise. Make sure you share prior with the insurer and/or source. They should be able to make suggestions properly.

It is the right thing can and husband or wife acquire an expression Life Insurance Protection Planning Services Fleming Island FL policy. The main reason why you’ll need one is it can provide your family the stability on your funds. We never know teach young people happen for you after at times. Of course, we can’t consider the idea that you should be dying but we can continue to expect worst things to take place. Whenever the time arrives that being a parent your income won’t be adequate or you and your partner won’t get any income anymore at least you have your insurance that can prepare you for your future. The already noted, that term life insurance had been established as a way to give families an possibility select the best place if time comes that they’re going to lost their stable income especially the death 1 partner will occur.

You are satisfied how the Insurance coverage is lengthier needed an individual can then cash their policy. Here’s the “Free” part. Almost all of the particular you had invested the actual last 30 years is returned back to you, as very tax efficient Accumulated Cash Price tag. The only a part of the premium you paid every month that isn’t returned for is the monthly policy fee, usually that is equal to about $7 per month, so huge deal.

For example, if you lost a leg at work, more considered rates right. However, losing both is! Therefore that for cancer, most policies only pay for a restricted range of cancers. So don’t think just when your policy says it covers cancer that you are currently covered all those types.

Leave a Reply